As someone who works in customer marketing and advocacy, I often get asked – with so many customer sentiment and satisfaction metrics out there, which one should companies focus on?

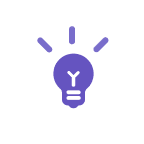

There’s Net Promoter Score (NPS), Customer Satisfaction (CSat), and Customer Effort Score (CES) – all valuable in their own right, but each is used for different purposes. In the first of our Ask Ari series, I tackled the core purpose and appropriate uses for NPS, CSat, and CES so you can determine which to prioritize in your customer experience efforts.

Episode 1

Episode 1

Net Promoter Score (NPS)

Of the three metrics we’re discussing, NPS is likely the most popular in the world of customer marketing and advocacy. The reason it’s so widely used is it identifies your brand’s promoters – those delighted customers who are willing to speak on your behalf. Identifying promoters allows you to target them for advocacy programs like reviews, referrals, references, and user-generated content creation, as well as do a regression analysis on their journeys to understand what led them to such a positive sentiment.

Here’s a refresher on how NPS works: on a scale of 1 to 10, you ask customers how likely they are to recommend your product or service to colleagues, friends, or peers. The question gets at the heart of whether they’ll actively promote you or not. You categorize respondents into three groups:

- Promoters (9-10 rating)

- Passives (7-8 rating)

- Detractors (6 or below)

To calculate NPS, you take the percentage of Promoters and subtract the percentage of Detractors (passives are not included in the formulation). This leaves you with a score that can range from -100 to +100. If your score is positive, it indicates you have more Promoters than Detractors. Many companies benchmark NPS scores within their industry to interpret how they’re performing compared to competitors.

Now, there’s a common misconception that NPS correlates strongly with churn. The belief is that Promoters stay loyal, Passives are at risk of switching, and Detractors are short-timers. I’ve seen research where companies like Dell discovered NPS has little correlation to churn across their entire customer base. Even Promoters defected at a 15-25% rate.

However, NPS does seem to predict churn among executive-level relationships. If your executive stakeholders are Promoters, it likely indicates a lower churn risk than if they are Detractors. So while NPS may not perfectly indicate churn for all customers, it remains a valuable metric – especially for zeroing in on your best advocacy candidates and gauging executive relationships.

Customer Satisfaction Score (CSat)

The next metric – Customer Satisfaction or CSat – is a measure of whether customers are satisfied with recent interactions with your company. It’s often used to evaluate one-off touchpoints across the customer journey, like an onboarding flow, technical support call, or knowledge base article.

You measure CSat on a scale of 1 to 10 or 1 to 5. Customers rate their satisfaction level, allowing you to quantify it. To calculate overall CSat, you divide the number of “satisfied” responses over the total number of responses and multiply it by 100.

For example: Using a scale of 1 to 5 with “Satisfied” as a rating of 4 or 5, if you had 85 satisfied responses out of 100 total responses, your CSat would be 85%.

The scores help you pinpoint bright spots and pain points in recent customer interactions. Unlike NPS though, CSat isn’t necessarily predictive of loyalty or churn since it focuses narrowly on one touchpoint. Still, if you consistently see low satisfaction scores for support, onboarding, or other key moments that matter, it warrants attention.

Where does CSat work best? Survey customers after specific interactions or transactions to determine if it was a positive or negative experience that may influence their perceptions. Common CSat survey use cases include:

- After a support call

- Following an onboarding or training flow

- Upon article view in a knowledge base

- When a direct touchpoint occurs between customers and company representatives

CSat provides actionable data on how satisfied customers felt with an employee, process, or piece of content – and identifies weak points to improve.

Customer Effort Score (CES)

Last but certainly not least is CES. Of the three metrics we’ve discussed, this one correlates most directly with churn risk. CES measures how much effort a customer exerts to get support, use your products or services, or find information. The easier you make aspects of the customer experience, the likelier they are to stay loyal.

You collect CES through a single survey question on a scale of 1 to 7:

“To what extent do you agree with the following: [Company] made it easy for me to handle my issue.”

1 = strongly disagree

7 = strongly agree

To calculate the overall CES, divide the number of 5, 6 and 7 responses (“easy”) by the total number of responses.

For Example: if 150 people out of 200 rated the experience a 5, 6 or 7, your CES would be 75%.

CES hones in on friction points that cause customers extra work and by removing points of friction, complexity, or confusion, you’ll tie better to higher retention and loyalty.

Because of the direct link between CES and churn risk, this metric should be a priority in your CX program – especially involving critical journeys like onboarding, support, account management, and product usage. Survey customers in the middle of or after those journeys to quantify ease or difficulty.

Key Takeaways Between NPS, CSat, and CES

We’ve covered quite a bit of ground on the NPS vs CSat vs CES debate. So to wrap up:

Use Net Promoter Score (NPS) to:

- Identify brand advocates for influencer/advocacy marketing programs

- Gauge executive relationship health

- Understand general advocacy likelihood

Use Customer Satisfaction (CSat) scores to:

- Evaluate the health of specific touchpoints and interactions

- Pinpoint bright spots and weaknesses in support, onboarding, etc.

- Guide micro-improvements across channels

Use Customer Effort Score (CES) to:

- Quantify friction points that drive churn

- Guide reductions in customer effort across critical journeys

- Correlate lower effort to revenue and loyalty

While all three metrics provide value, I recommend emphasizing CES since ease directly links to retention. Reduce effort, and you reduce churn risk while building loyalty.

Of course in practice, using a combination of NPS, CSat, and CES at different points provides powerful insights. As you implement the metrics, determine which ones provide leading indicators for your desired outcomes around satisfaction, loyalty and revenue. Let the use cases and results guide your priorities instead of any preconceived notions.

Now you’ve got a better grasp for applying the right metric at the right time. The next step is gathering customer feedback through surveying and analysis to benchmark where you are today. Combining that with journey mapping and voice of the customer insights illuminates the biggest opportunities for driving customer loyalty.

With the right vision and game plan around these metrics, you gain the power to retain more happy customers.